Southern Water is suggesting to pay ₤ 275m in rewards over the next 5 years whereas growing virtually ₤ 4bn of contemporary monetary obligation.

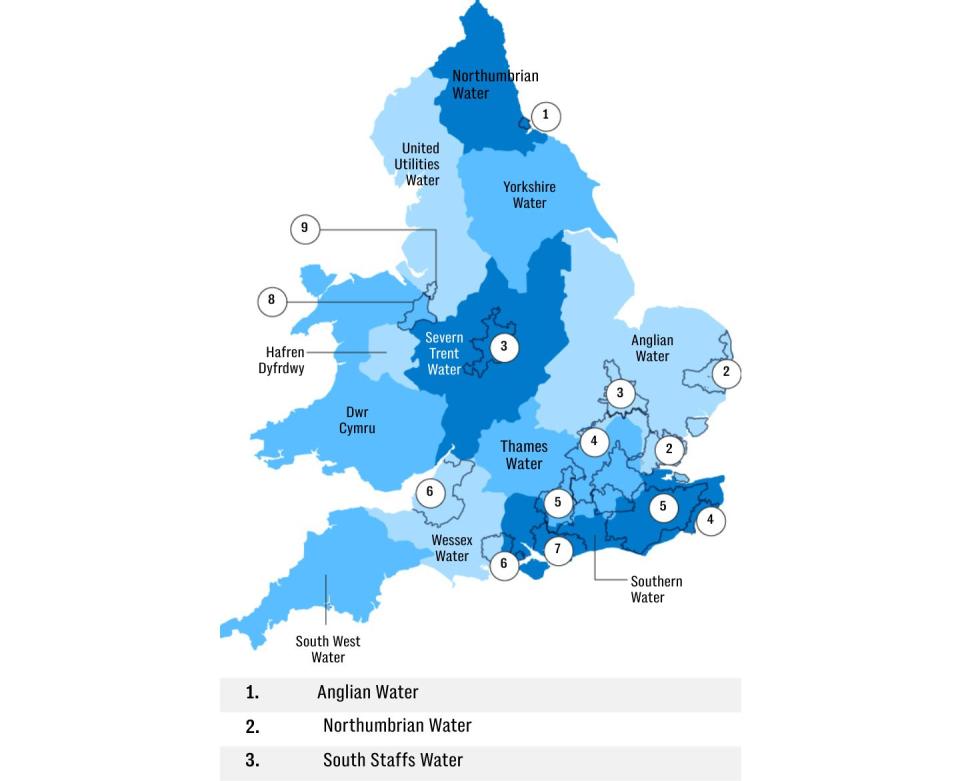

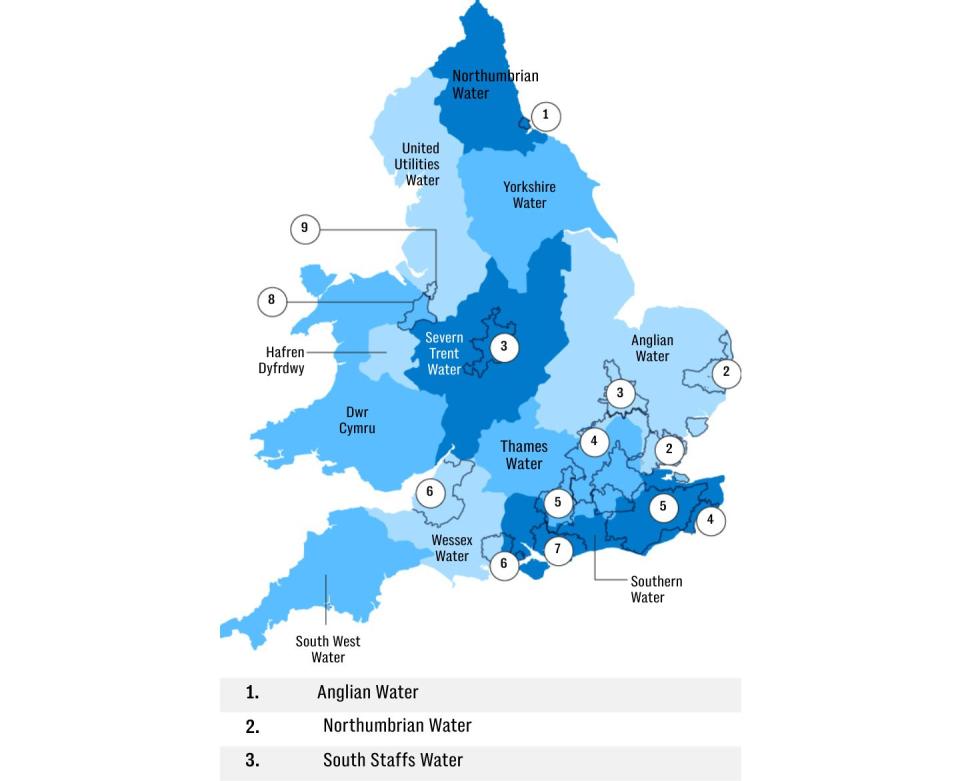

The enterprise, which presents 4.7 m shoppers in Kent, Sussex and Hampshire, is desiring to award buyers whereas enhancing its web monetary obligation stack from ₤ 6bn to ₤ 8bn by 2030.

One of the most important recipients of the returns funds will definitely be the enterprise’s bulk proprietor, Macquarie.

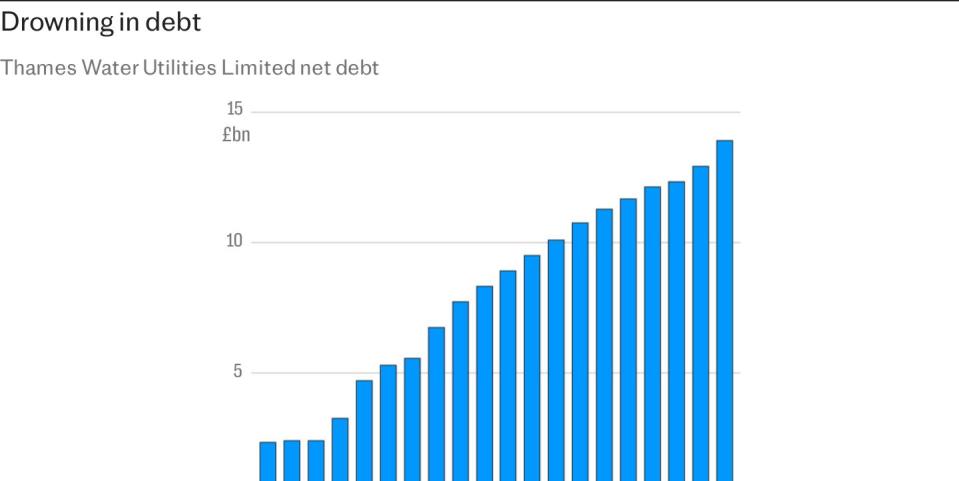

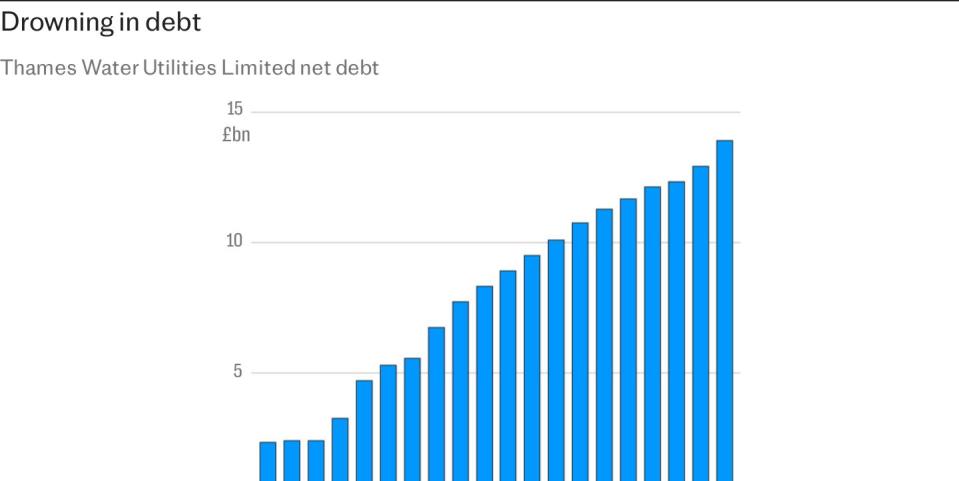

The Australian monetary funding titan has really previously been criticised over its ownership of Thames Water between 2006 and 2017, a length all through which it elevated the enterprise’s loanings to ₤ 11bn and secured an approximated ₤ 2.7 bn of rewards.

Thames Water is at present in jeopardy of collapse beneath the load of its enormous monetary obligation stack.

In its latest service technique despatched to Ofwat, Southern launched methods to pay rewards of ₤ 275m in between 2025 to 2030.

It has really at present likewise notified financiers of its intent to the touch bond markets for ₤ 3.8 bn of brand-new monetary obligation in an effort to bolster its monetary assets.

As effectively as growing brand-new monetary obligation, Southern claimed it could actually likewise search for an extra ₤ 650m from buyers led by Macquarie.

While growing brand-new monetary obligation will definitely enhance the dimension of its annual report, it is going to actually likewise concern managers with numerous additional kilos additional in loaning bills.

The capital-raising methodology is developed to boost Southern’s monetary assets because it enters into battle with regulatory authority Ofwat over how much it will be allowed to increase customer bills

Southern’s relocation comes versus a background of increasing fear over the power business’s unsteady monetary assets, sustained by the potential of Thames Water entering the Government’s special administration regime

While Southern doesn’t encounter an prompt money cash drawback like Thames, there are anxieties of air pollution all through the UK’s water business if Ofwat rejects to allow a considerable rise in household prices.

Southern, along with Britain’s varied different public utility, is presently bargaining with Ofwat to see simply how a lot prices can climb over the next 5 years in a process known as the 2024 value testimonial (PR24).

The regulatory authority has really knowledgeable Southern it will possibly simply enhance prices to ₤ 603 yearly but Southern wants to increase them to £734 typically by 2030.

It protests this background that Southern has really revealed its beneficial ₤ 3.8 bn monetary obligation elevating.

Influential rankings firm Moody’s in July claimed it was making an allowance for decreasing Southern’s aged monetary obligation to scrap standing owing to anxieties over Ofwat’s choice on prices, which may damage Southern’s capability to pay financiers.

Bond markets have really likewise remodeled versus a number of of the enterprise’s monetary obligation in present months, with the return on Southern’s 2026 bonds growing to 13.5 pc.

Southern requires to speculate giant quantities on boosting its community, but this may be made more durable if it falls beneath scrap area since it could actually must pay monetary obligation financiers additional in loaning bills.

Macquarie claimed it’s intending to position an extra ₤ 650m proper into Southern in between following yr and 2030 to help preserve its investment-grade rating.

The relocation is anticipated to press Southern’s debt-to-equity proportion to listed beneath 70pc in 2027– a level it requires to protect with a view to pay rewards beneath Ofwat’s rules.

Southern’s cash supervisor, Stuart Ledger, claimed: “Raising debt for funding and rolling over current bonds is a traditional a part of enterprise.

“Our exciting plan for the next five years calls for our biggest ever investment to deliver environmental protection and a resilient water future for the region.”

On the rewards, Mr Ledger included: “Our authentic PR24 submission included assumptions for dividend funds. Our revised plan has grown resulting from new regulatory drivers and now anticipates an additional £650m fairness injection to help supply of our record-breaking funding, reasonably than dividend funds.

“The company does know that investors contribute to the company in expectation of a return and we hope to return to prudent dividends in line with our stated dividend policy that we highlight in our financeability disclosure.”