It had not been prolonged in the past that nearly each electrical automotive (EV) provide was skyrocketing in price. In 2021, for instance, market buzz went to a excessive temperature pitch. Several EV enterprise– consisting of Rivian Automotive and Lucid Group— debuted on most people markets with incredible pleasure, whereas customary automotive producers have been flaunting regarding methods to strongly improve their EV schedules.

An incredible deal has truly altered ever since. And after a excessive market sell-off, it’s time to go deal shopping for. One famend EV provide particularly should be catching your focus right this moment.

Is this famend EV provide lastly a deal?

Tesla ( NASDAQ: TSLA), the automotive producer led by the debatable Elon Musk, took {the marketplace} by twister a years again. It’s thought of given by some right this moment, but it wanted to confirm to a cynical buyer base that EVs could be attractive, respected, and downright gratifying.

Its multibillion-dollar monetary investments proper into its billing community, on the similar time, stimulated worldwide want for a automotive group that, a minimal of on the time, nonetheless had a higher total possession expense than customary internal-combustion selections.

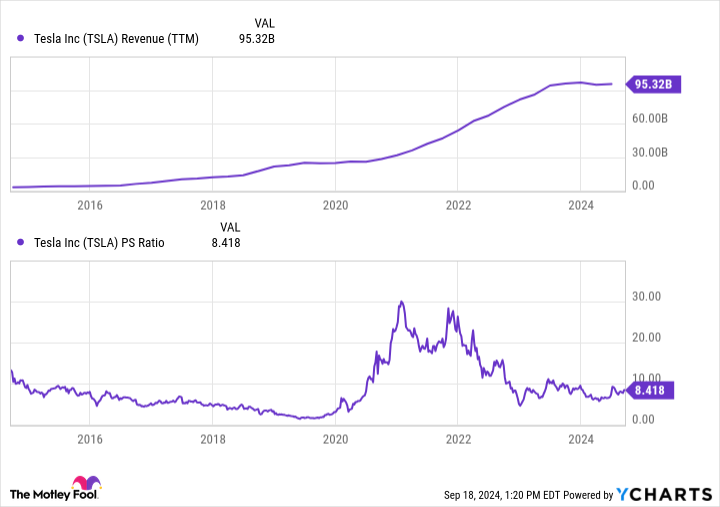

Tesla’s very early transferring firm profit supplied it a stable grip in a sector that had structurally underinvested in its EV schedules. It had the staff, assets, follower base, and making talents to scale up manufacturing rapidly equally as EV want started to take away. From 2018 to 2022, for instance, gross sales expanded by a powerful 357%.

But after that an level happened. EV gross sales within the united state remained to climb up, but slower than anticipated. This positioned a large injury within the prices value determinations {the marketplace} had truly beforehand designated to EV provides.

From 2022 to 2024, for instance, Tesla’s evaluation dropped from nearly 30 occasions gross sales to below 10 occasions gross sales– a two-thirds lower over 24 months. Other EV producers like Rivian and Lucid noticed comparable evaluation decreases.

More currently, Tesla’s earnings base has not simply squashed, but has likewise decreased in particular quarters. To be affordable, the availability remains to be pretty pricey at 8.4 occasions gross sales. But if in case you have truly been ready to amass proper into this famend EV provide, this may be your alternative. One reality particularly must acquire you delighted.

Tesla remains to be the king of EVs

While Tesla is related to numerous different group endeavors, consisting of solar energy and battery cupboard space, higher than 90% of its earnings base remains to be sure in its car part. Its future will definitely be made or broken primarily based upon the success of this group, and lots of its evaluation is linked to its future.

It’s important to do not forget that it nonetheless regulates a number one share of the united state EV market. Various approximates safe it with a 50% to 80% market share.

And want for EVs stays to develop no matter a lower in projections. Over the next 5 years, residential EV gross sales are at the moment anticipated to develop by higher than 10% yearly, with market earnings for EVs within the united state going past $150 billion by 2029.

Globally, EV gross sales are anticipated to cowl $1 trillion by 2029. That’s glorious data taking into account Tesla has truly a forecasted 39.4% market share internationally, above the next 8 rivals integrated.

Put simply, the EV market remains to be Tesla’s to shed. It has much more assets, much more brand-name acknowledgment, and rather more making capability than any kind of varied different rival. And right this moment, quite a few customary automotive producers are drawing again on their EV methods, presumably enabling the enterprise to maintain its main market setting for a number of years to search out.

We might recall at 2024 as a transparent outlier in Tesla’s long-lasting growth trajectory. Sales are anticipated to lower by 8.2% this yr. But in 2025, consultants are anticipating a rebound, with earnings leaping by 15.8%.

Is the availability nonetheless pricey at 8.4 occasions gross sales?Absolutely But its long-lasting assure continues to be undamaged, and the prevailing evaluation is a beloved one deal contrasted to years previous.

If you rely on EVs long-term, it’s powerful to not financial institution on the prevailing market chief, additionally if there are some near-term difficulties when driving prematurely. It would definitely be a speculative wager, but financiers which have truly been contemplating Tesla for a number of years whereas awaiting a pullback wants to consider a bit monetary funding. If shares stay to lower, perhaps a primary risk for dollar-cost averaging.

Should you spend $1,000 in Tesla right this moment?

Before you purchase provide in Tesla, contemplate this:

The Motley Fool Stock Advisor knowledgeable group merely acknowledged what they suppose are the 10 best stocks for financiers to amass at the moment … and Tesla had not been amongst them. The 10 provides that made it could actually generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … if you happen to spent $1,000 on the time of our suggestion, you would definitely have $710,860! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of help on creating a profile, regular updates from consultants, and a couple of brand-new provide selections month-to-month. The Stock Advisor answer has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 16, 2024

Ryan Vanzo has no setting in any one of many provides identified. The Motley Fool has placements in and advisesTesla The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now was initially launched by The Motley Fool