Artificial intelligence (AI) is the preferred investing theme of the minute. Much ink has really been splashed on the innovation’s unimaginable energy and doable monetary impact. Could or not it’s as transformative as its evangelists would definitely have you ever suppose? PwC– among the many “big four” bookkeeping corporations– thinks AI can embody $15.7 trillion to the worldwide financial local weather by 2030. If that reveals to be actual, it undoubtedly fulfills the mark in my publication.

While Nvidia took highlight, yet one more AI enterprise, Palantir ( NYSE: PLTR), merely handed a big landmark which may help enhance its account and provide price. Founded in 2003, the enterprise undoubtedly isn’t brand-new, but present improvements in AI are turbo charging the enterprise’s capability to make a revenue. The enterprise’s share price did the identical, up 150% this 12 months alone.

This made it certified for incorporation within the S&P 500, and Palantir formally signed up with the index late final month. What does this imply for the enterprise?

Joining the S&P 500 is a big supply and would possibly affect Palantir’s provide price

The S&P 500 is an index included the five hundred greatest enterprise within the united state by market capitalization. It’s likewise amongst one of the crucial widespread and outstanding indexes about– so outstanding that it’s continuously made use of as a proxy for the inventory alternate general. This presence usually equates to an uptick in monetary funding from the retail market. Some of those capitalists are studying in regards to the enterprise for the very first time, whereas others see its incorporation as a mark of authenticity.

Beyond retail, nonetheless, the index is tracked by all form of funds, just like the uber-popular SPDR S&P 500 ETF Trust or Vanguard 500Index Fund When a agency indicators up with the S&P, there’s a flooding of funding proper into the availability as these funds regulate to match the index.

All this brings about what’s in some circumstances referred to as the “S&P 500 effect”– a bump in provide price after being consisted of within the index. Take Nvidia, for example. The chipmaker was revealed because the substitute for the collapsing Enron again in November of 2001. In the month that adhered to, its provide price rose better than 30%. Will this happen to Palantir?

Correlation just isn’t causation

Unfortunately, the influence may be much more of a coincidence. A analysis examine appointed by the Federal Reserve Bank of New York thought of the influence and situated that there really isn’t a substantial amount of proof for it, or a minimal of that any kind of straight influence is transient.

Stocks that receive contributed to the index generally tend to presently get on a progress. They have earlier vitality. The analysis revealed that this vitality was the important thing supply of effectivity over the long-term post-inclusion. Essentially, the favorable price exercise would definitely have occurred with or with out being included. Still, whether or not it’s the purpose or in any other case, the reality stays that when a agency is contributed to the S&P 500, it tends to do effectively.

Palantir is interesting, but watch out for its analysis

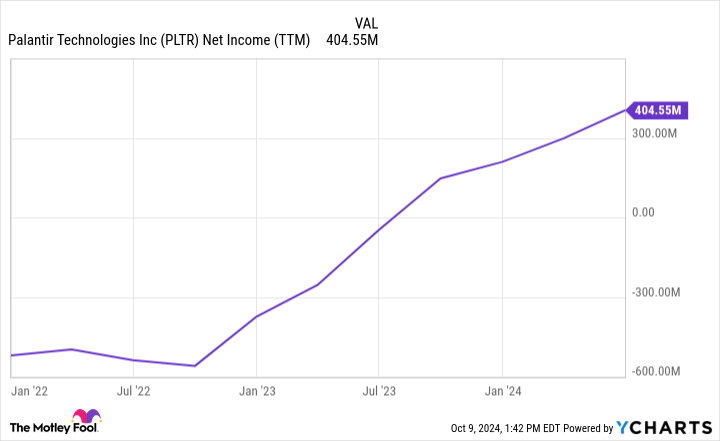

The enterprise is revealing stable growth in its top-line earnings and unimaginable decreases in working prices. This implies massive growths in its earnings. Take a check out the graph revealing the departure in 2022.

These are patterns you plan to see. The enterprise is remaining to find success within the financially rewarding globe of federal authorities agreements and revealed final month that it had really landed yet one more, this time round with the united state Army, to assist improve its AI skills. The brand-new settlement implies the enterprise is presently coping with all 5 of the united state armed options.

Palantir’s as a agency seems great. Its income growth seems readied to proceed its fast enhance. However, its capability to earn cash isn’t the issue. Sometimes a beautiful enterprise can find yourself being a not-so-great monetary funding if it’s valued too costly. I imagine that holds true under. While analysis metrics will be rickety for some time as a agency finally begins to make a revenue, I cannot disregard merely precisely how out of order its provide price seems to be.

It presently has an forward price-to-earnings proportion (P/E) of 103 and a price-to-sales proportion (P/S) of 41. Compare that to Nvidia, which is valued at pretty a prices proper now, which has an forward P/E of 46 and a P/S of 26. Alphabet‘s metrics are 21 and 6, particularly.

With the availability price the place it’s, I cannot advise the availability to a variety of capitalists. I imagine there are much better areas to put your money. However, in case you are younger with a excessive risk resistance and a very long time perspective, perhaps an intriguing play.

Should you spend $1,000 in Palantir Technologies now?

Before you purchase provide in Palantir Technologies, think about this:

The Motley Fool Stock Advisor skilled group merely decided what they suppose are the 10 best stocks for capitalists to accumulate presently … and Palantir Technologies had not been amongst them. The 10 provides that made it would create beast returns within the coming years.

Consider when Nvidia made this itemizing on April 15, 2005 … should you spent $1,000 on the time of our suggestion, you would definitely have $812,893! *

Stock Advisor presents capitalists with an easy-to-follow plan for fulfillment, consisting of help on growing a profile, routine updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor resolution has better than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since October 7, 2024

Suzanne Frey, an exec at Alphabet, belongs to The Motley Fool’s board of supervisors. Johnny Rice has placements in SPDR S&P 500 ETFTrust The Motley Fool has placements in and advises Alphabet, Nvidia, Palantir Technologies, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Palantir Just Joined the S&P 500. History Says the Artificial Intelligence (AI) Stock Will Do This Next. was initially launched by The Motley Fool